Matchless Tips About How To Build Business Credit Score

How to build business credit 1.

How to build business credit score. Up to 20x higher limits. Apply early and keep your spending small and manageable so you can repay on time, every time. It’s important to separate your business.

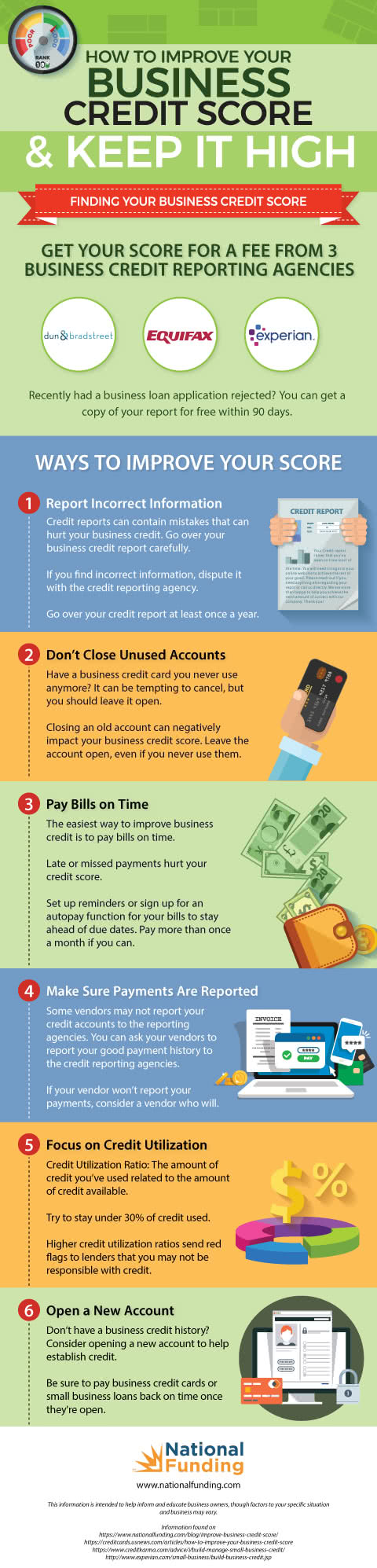

The definition of a good credit score varies from lender to lender, but generally speaking, a score of 700 or above is considered good. Incorporate your business or form a limited liability company (llc). Your credit report dictates your credit score.

If you’re eventually planning to apply for a. 2 years in business & $200k annual revenue recommended for largest selection. Credit scores are calculated by assessing specific categories.

Here are a few educational tips that can help you start building credit now and in the future: The program is easy to. Up to 20x higher limits.

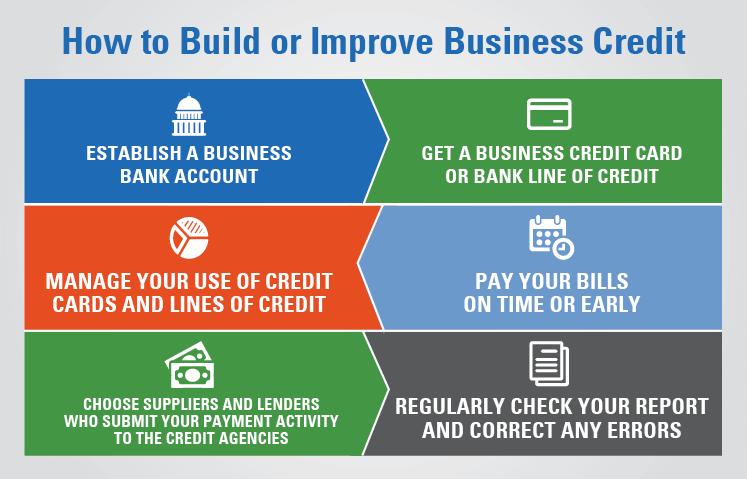

Protecting your personal credit score. Stop wasteful spend and save thousands. There are several steps you can take to begin building business credit:

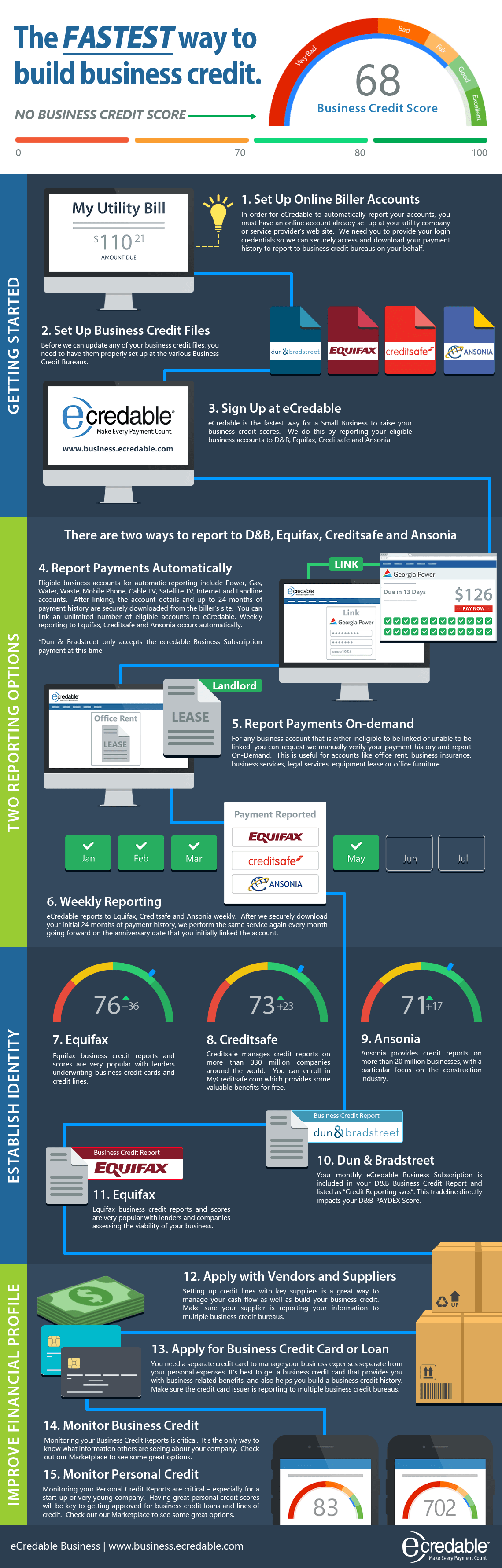

Each bureau uses this data to help generate a business credit score, which generally ranges from zero to 100. Establishing a federal ein number by legally registering your business. Start building business credit immediately without a personal credit check or guarantee.