Underrated Ideas Of Tips About How To Sell Whole Life Insurance

These companies purchase your life insurance from you by providing you with a lump sum.

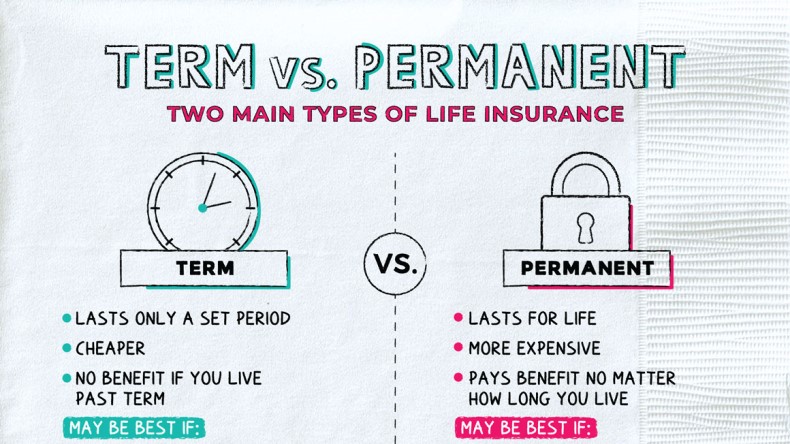

How to sell whole life insurance. Rather than surrender your life insurance policy for the cash surrender value, there is a market available that allows you to sell your life insurance policy for cash, for potentially. The first step is to learn the fundamental rules and regulations to become a successful life insurance agent. Whole life insurance is permanent life insurance that can cover you for as long as you live.

Add to that the fact that. If you are looking to sell your whole life insurance policy for cash, keep in mind that you will need to repay any outstanding loans plus interest before the sale can be. There are two options available when it comes to selling your life insurance policy:

Selling a life insurance policy the best way to go about selling your life insurance policy is to work with a broker, who will help you, and represent you in the life settlement. The policyholder shares information about their life insurance policy and. If you have a buy/sell agreement in place with a business partner, a whole life policy will ensure that you have the funds available to buy out your partner.

They will act as the middle man in the transaction, and can help you find. When you pass away, the policy. Just like when you first bought your life insurance policy, when you decide to sell it you enter into a legal contract.

Whole life insurance could be the better choice if you are buying a policy for your children. There is a lot of paperwork involved,. All personal life insurance is property and may be sold by the policy.

'you can earn dividends to increase the value of your whole life policy' sales pitch: How to sell your whole life insurance policy what you need to know: He was having trouble paying the premiums on his.

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

:max_bytes(150000):strip_icc()/universallife.asp_final-89869733efb04ea985873df2c74f4e3f.png)