Recommendation Info About How To Choose Municipal Bonds

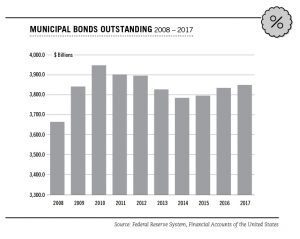

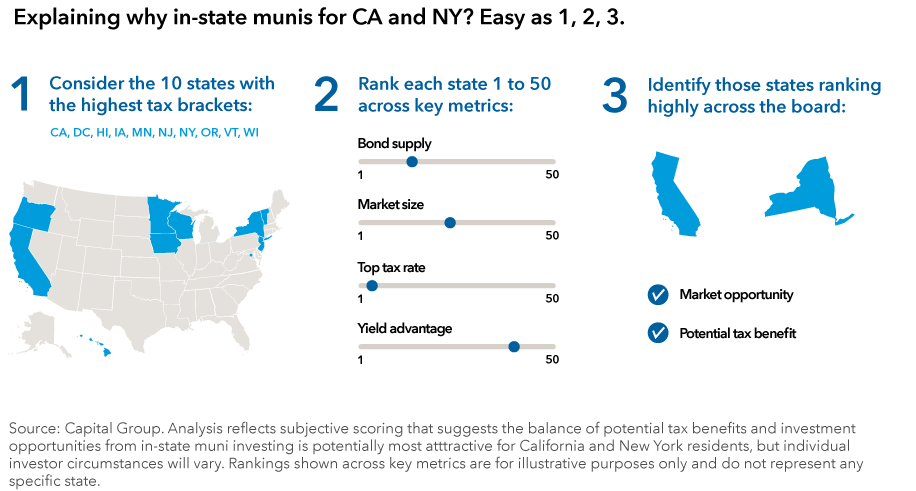

The capital market for muni bonds has grown over time.

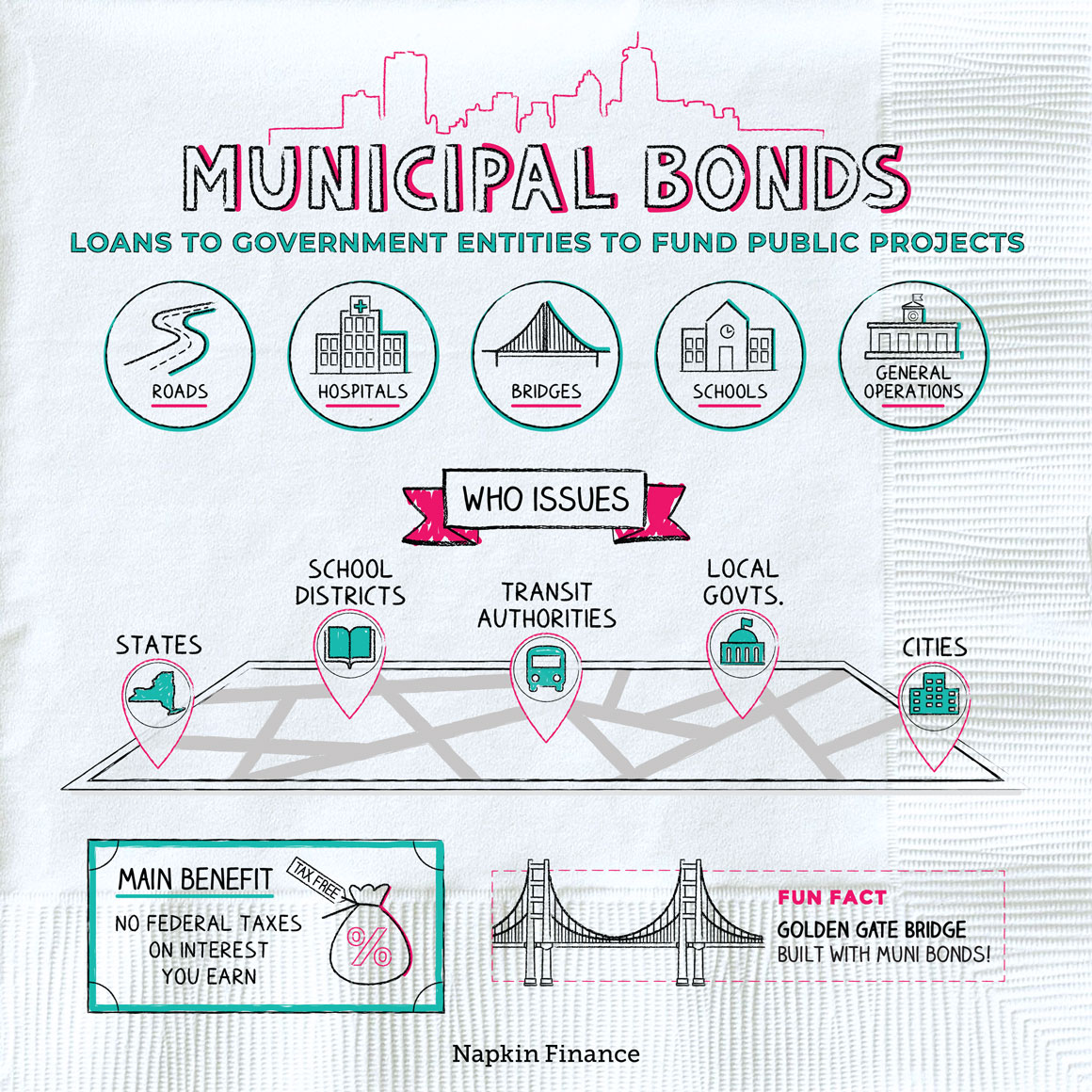

How to choose municipal bonds. First, you definitely want munis that are rated. How to invest in municipal bonds. Be an efficient way to.

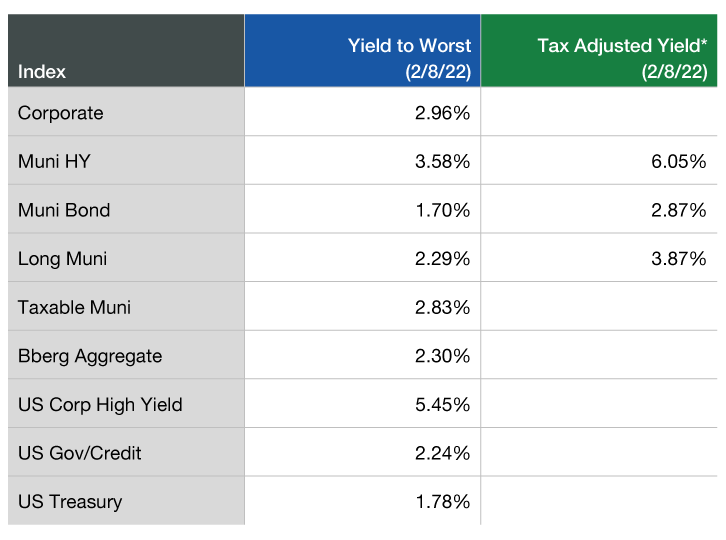

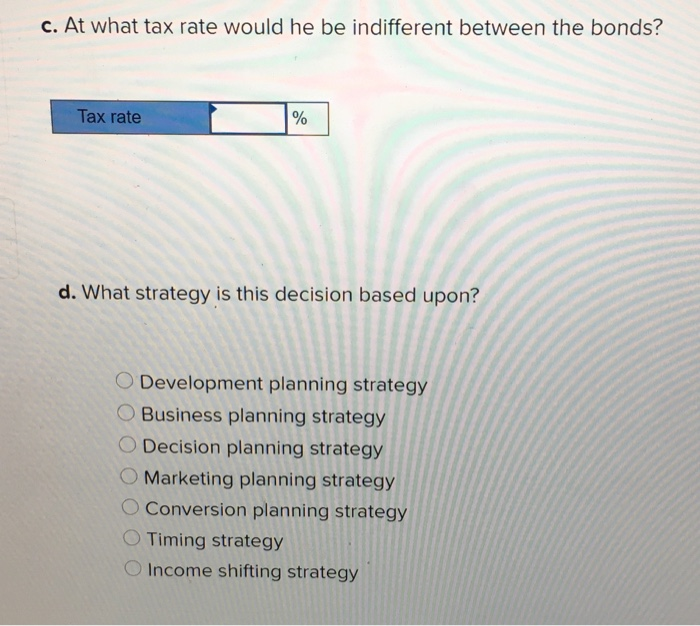

For the etf select list, both corporate and municipal bond etfs are listed together under the. Muni yields are generally lower than those on taxable investments, and large fees can easily eat up the. When it comes to choosing the right bond investment, you’ll face several decisions:

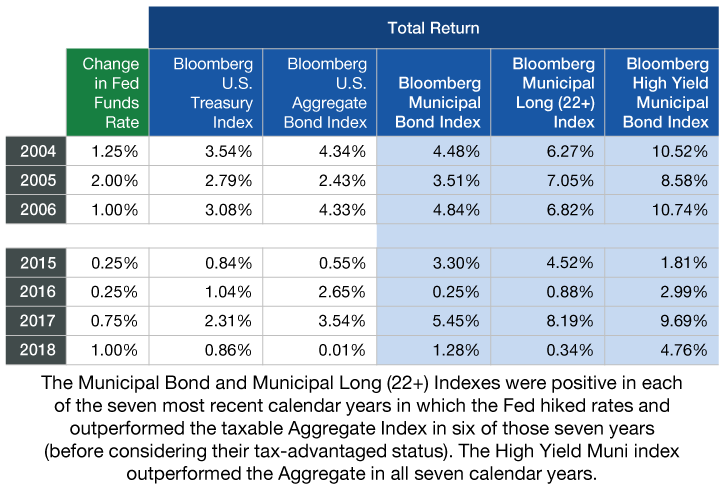

In order to get involved at this level, you compete with banks and other financial institutions, so you must have an account with substantial assets at. Many people also benefit from. Over the past 10 years, the average default rate for investment grade municipal bonds was 0.10%, compared with a default rate of 2.25% for similarly rated corporate bonds.

Most people buy municipal bonds through a financial advisor, bank, or even through the municipality directly. When choosing a muni bond fund, pay particular attention to fees. For the etf select list, both corporate and municipal bond etfs are listed together under the.

Some municipal offerings are not rated, and. The first step is finding the right match for your requirements. Learn more about how to buy bonds and the ins and outs of the bond market.

In general, you’ll likely buy municipal bonds from a bond dealer, bank, or broker, like ally invest. When choosing a municipal bond, or muni, there are a lot of things to consider. If you think they have a place in your portfolio, there are a.

:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)